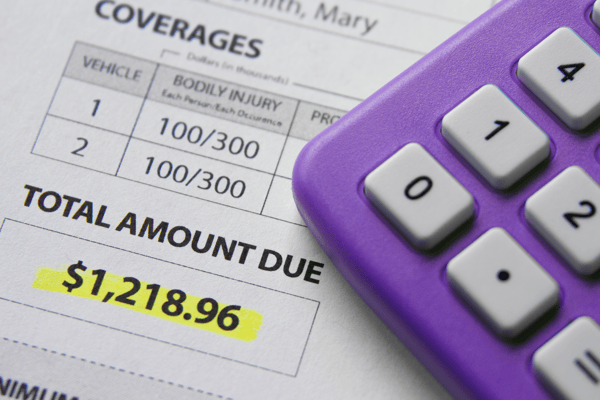

Everyone is familiar with the purpose of car insurance, but it is actually often misunderstood. Any misconception about your vehicle’s protection can come with costly consequences.

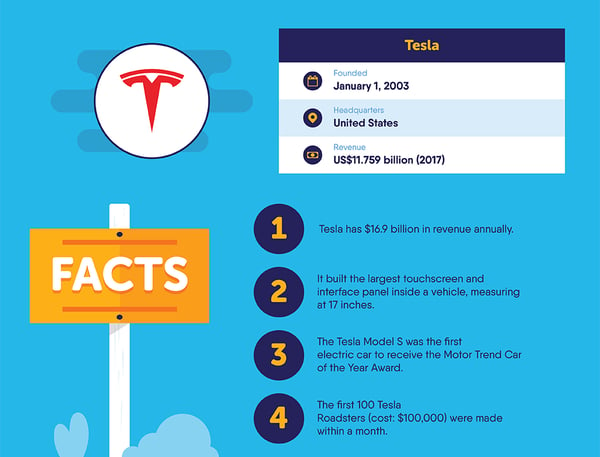

A quick look at this infographic by Carsurance shows that the automobile ecosystem is complex. And the same can be said about the insurance industry.

To understand how auto insurance products work, let us debunk the most common erroneous beliefs about them first.

Car Colors Affect Insurance Rates

Many people believe that red vehicles cost more to insure. While this notion can be true, the color does not make any difference.

The real reason why more expensive insurance is attached to cars in red is that they tend to be owned by men who drive aggressively. Insurers consider such policyholders as riskier customers, so they raise the rates.

The Driver Is Culpable for the Damage

If your car gets involved in an accident, you may be held accountable for the damages even if you were not behind the wheel. The driver’s insurance may only come into play when the costs exceed the limits of your own policy.

Addition of More People to the Policy Increases the Premium

Strictly speaking, the overall cost of your insurance premium will go up when you add more members of your family to your policy. However, the price per person will decrease.

You may even get discounts because many insurers do not mind offering incentives to attract more business.

Comprehensive Insurance Provides Blanket Coverage

No, comprehensive insurance does not cover everything. This particular type of product only provides reimbursements for vehicular damage caused by things not related to traffic.

The policy should spell out the specifics, but it generally pertains to coverage for theft and Acts of God.

The Adjuster Is on Your Side

The adjuster is your insurer’s friend, not yours. This professional is not being paid to help you receive as much money as possible. If you sustained personal injury after a collision, consult an attorney to represent you in the settlement.

Claim Denial Is Final

Insurance companies are powerful, but they are not powerful enough to have the last say in claims. You can fight a wrongly denied claim to ultimately receive the compensation you deserve.

If truth be told, most of the things about auto insurance are not straightforward. Exercise due diligence to compare policies properly and to understand your entitlements before signing on the dotted line.

Thank you to Megan from Carsurance for this informative blog, as well as this excellent infographic, "Who Owns Which Car Brands". Check out a section of it below and click the image to dive into the full image!

Posted in Education